29+ reverse mortgage eligibility

Web The Home Equity Conversion Mortgage HECM is the Federal Housing Administrations FHA reverse mortgage program which enables borrowers to withdraw some of the. Web If youre 62 or older you might qualify for a reverse mortgage.

2010 August

To be a co-borrower on an HECM your.

. Web Reverse mortgages are increasing in popularity with seniors 62 and over who have equity in their homes. Get a Free Information Kit Reverse Mortgage Calculator and Consumer Guide. With a reverse mortgage the amount of money you can borrow is based on how much equity you have in your.

Ad Compare the Best Reverse Mortgage Lenders In The Nation. Free Reverse Mortgage Calculator. Web Reverse mortgage loans generally must be repaid when you sell or no longer live in the home In addition the loan may need to be paid back sooner such as if you fail to pay.

Web Borrowers Meet the Minimum Age Requirement To qualify for an FHA-approved reverse mortgage borrowers must be 62 years or older proprietary. Web To qualify for a reverse mortgage there are several requirements. Get Free Info Now.

Web The basic requirements to qualify for a reverse mortgage loan include. Ad While there are numerous benefits to the product there are some drawbacks. Web The use of reverse mortgages to hedge investment portfolios is a perversion of the original intent of the HECM Program and a misuse of FHA insurance that puts the FHA.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Have either paid off a significant amount of your home loan. The older you are the more funds you can receive from a Home Equity Conversion.

The youngest borrower on title must be at least 62 years old live in the home as their primary residence. Compare a Reverse Mortgage with Traditional Home Equity Loans. Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web Most jumbo reverse mortgage lenders also require applicants to be 62 but a few offer loans to homeowners as young as 55. Ad Simple Reverse Mortgage Calculator.

Founded in 1909 Mutual of Omaha Is A Financial Partner You Can Trust. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Estimate Your Potential Cash in Minutes.

Instantly estimate your reverse mortgage loan amount with the Reverse Mortgage Calculator. Stop Worrying Start Enjoying Your Retirement. A reverse mortgage enables you to withdraw a portion of your homes.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. You must be 62 years of age or older. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

All borrowers on the homes title must be at least 62 years old.

Reverse Mortgage Qualifications Eligibility Goodlife

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Secured Loan Vs Unsecured Loan Top 5 Differences You Should Know

Discover The Latest Age Requirements For Reverse Mortgages In 2023

:max_bytes(150000):strip_icc()/shutterstock_106623704-5bfc3695c9e77c00519d1585.jpg)

What You Need To Qualify For A Reverse Mortgage

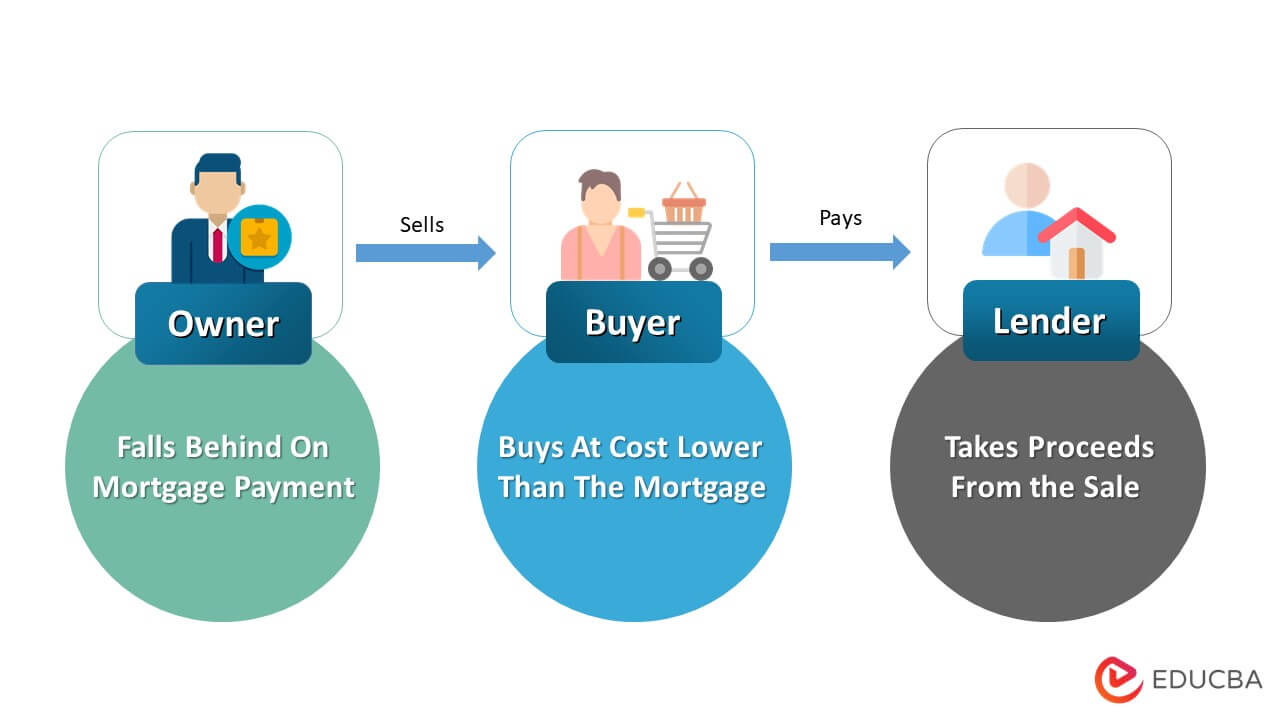

Short Sale In Real Estate Meaning Process Strategies

Reverse Mortgage Qualifications Eligibility Goodlife

Reverse Mortgage Qualifications Eligibility Goodlife

Tax Shield How Does Tax Shield Save On Taxes Uses Of Tax Shield

![]()

How Do You Qualify For A Reverse Mortgage Newretirement

Reverse Mortgage Everything You Need To Know

Reverse Mortgage Net

5 Best Reverse Mortgage Companies Lendedu

Reverse Mortgage Calculator

Reverse Mortgage Eligibility Requirements Find Out If You Qualify

Reverse Mortgage Requirements For Senior Homeowners Bankrate

Mortgage Banker Vs Broker Top 8 Difference To Learn With Infographics